Do All Repairs Need To Br Made For A Va Loan Inspection

VA minimum property requirements accept inverse. The department made all-encompassing amendments and additions in a new edition of its rulebook, published March 28, 2022. The data below is up to date and may be more than accurate than advice you read elsewhere that predates the latest guidelines.

You already know about the Section of Veterans Affairs' eligibility requirements for borrowers. But did you lot know it likewise sets strict eligibility thresholds for the homes it's willing to lend against?

These are chosen the VA minimum property requirements (MPRs) and they are important when buying a home with a VA loan.

You lot may have found a home, merely then discovered that it's not able to be financed with VA. Post-obit you'll find ways to bargain with VA loan MPRs effectively.

Overcoming VA MPRs

And, if you fall in honey with a dwelling that doesn't comply with those MPRs, you may struggle to buy it with a VA loan. That doesn't mean you won't be able to at all. But the current owner may first demand to carry out repairs to go it over the threshold. Or y'all may need to buy the place with a bridge loan so you can carry out the necessary work before getting a VA loan.

A bridge loan is simply an alternate, temporary loan blazon which you replace with a VA loan later.

In rare circumstances, you may exist able to become a waiver from the VA for repairs. Merely yous'll need your lender on your side. And the abode must already exist safety, sanitary and structurally sound. And at that place's no obligation on the VA to issue whatsoever such waiver.

VA minimum property requirements: What'southward important and what'due south not

Before getting onto the pregnant hurdles, permit'southward articulate upward one thing. VA appraisers should take the general condition of the home into account when reaching a valuation. But they shouldn't cake a loan solely because of modest stuff, such as poor decoration or an overdue service of the furnace. The VA'due south guidelines say:

The appraiser should non recommend repairs of corrective items, items involving minor deferred maintenance or normal wear and tear, or items that are inconsequential in relation to the overall condition of the property. While minor repairs should not exist recommended, the appraiser should consider these items in the overall condition rating when estimating the marketplace value of the holding.

The overarching objective of MPRs is to make certain the buyer is getting a abode that is "condom, structurally sound and sanitary." But, the VA says, "The scope of MPRs also includes problems related to the property's location and legal considerations."

Consummate list of VA MPRs

The main player in all the following is your appraiser. That'due south the person who makes sure you're non paying too much for the home – and does then much else.

Marketable real estate

The home must be a single dwelling (which may include a multi–family unit dwelling house with two to four units) that'southward legally real estate and "readily marketable." That last bit means that information technology tin easily exist sold later. So it shouldn't exist likely to sit around for years waiting for a buyer to turn up.

You may exist able to buy more than than one package of state but they need to exist "contiguous." That means they adjoin each other. If there's a road or waterway separating the parcels, the appraiser has to assess how that impacts the usefulness and saleability of the property.

Space and construction requirements

The habitation must be big enough for you and whatever other residents to alive, slumber, cook and eat. It'll as well need germ-free facilities.

If its structure is unusual (for case loghomes, homes with an earth roof or in a dome shape), it must still comply with local building codes. And the appraiser has to piece of work out whether its out–of–the–ordinary qualities will brand it less marketable when the time comes to sell once more.

Access

Yous must be able to admission the home with a vehicle or as a pedestrian safely all year round. That access may exist from a public or private route.

However, if neighbors share the private road, at that place may exist legal bug. The VA wants to encounter a off-white, enforceable agreement about who pays for maintenance.

And you must have a permanent legal right to gain access. So, if you lot have to pass over other people's state to go to your habitation, there must be an "easement" (a legal correct to trespass) already in place.

There are too access rules concerning row houses and those built on the property line. These more often than not concern accessing your back yard (information technology's fine if you can simply do so through the home) and being able to maintain the exterior.

Encroachments

Suppose a neighbor is "encroaching" (intruding) on the home. Perchance he'southward built a argue or part of his garage a pes your side of the boundary. Or he might have a roof that extends over it. Or maybe your seller is encroaching on a neighboring property.

Either way, the appraiser must report it. And someone will have to resolve it earlier you'll get your VA loan.

Drainage and topography

Drainage rules are exactly what y'all'd expect. Waste and surface water must flow off your site chop-chop and positively. And information technology mustn't "pond" (course pools) on your country.

Topography concerns physical threats to your site. So it mustn't be subject to mudslides, avalanches or similar from neighboring properties.

Geological or soil instability, subsidence and sinkholes

This concerns geological risks posed past your ain site. And the merely thing worse than your appraiser spotting these is her missing them.

Considering you lot actually don't desire to detect you have mudslides or sinkholes when you already own the identify. And the same goes for "subsidence" (the gradual caving in or sinking of an surface area of state), which can undermine the home's foundations in a very expensive fashion.

Suppose your appraiser suspects any of these to be risks. And so you or the owner will need to arrive an expert geologist to say different. And, if at that place's evidence of existing damage to the home from such causes, a licensed contractor will have to fix it before you get a VA loan.

Special overflowing hazard surface area

If you desire to buy a home or plot that floods regularly, you won't get a VA loan. In that location are restrictions even if information technology doesn't but is in a loftier–risk area.

FEMA designates special flood hazard areas (SFHAs). You tin nevertheless buy a home in ane of these. But only if yous buy flood insurance. If the home'southward uninsurable or you can't become that insurance, the VA won't guarantee your loan.

That terminal paragraph applies in about all SFHAs. But it doesn't (you won't need flood insurance) if your home's in those zoned B, C, X or D by FEMA.

Non–residential use

VA minimum holding requirements don't bar you from buying a abode that doubles upwardly every bit your workplace. Only information technology does impose atmospheric condition.

The belongings must primarily be for residential employ. Then you lot can't buy a huge warehouse with a tiny home in the corner. And your local say-so must exist absurd with the business apply yous intend. So the belongings must either exist correctly zoned or the authority must admit its acceptance of your not–befitting use.

3 more rules:

- The business use mustn't detract from the residential character of the holding

- Only one business concern is allowed to operate from the home

- The appraiser mustn't add together value for business utilise or commercial fittings when determining how much the abode is worth

You tin come across what the VA's doing here. It guarantees loans on residential (not commercial) property but it'due south happy to aid when it reasonably can.

Zoning

Apparently, the VA wants to be sure the domicile is correctly zoned. That's mostly considering information technology may be difficult for you to later sell a place that'due south wrongly zoned – and that could touch on the value of the belongings.

It may still be willing to approve your loan if the dwelling house is incorrectly zoned. But but if the local authority accepts its status. This is chosen "legal non–conforming." All the same, the appraiser must annotation that fact on her appraisement and assess whether (and by how much) that will bear on the property'due south value.

Some areas enforce their local lawmaking requirements whenever a domicile is sold. If the identify you want to buy is in such an area, your appraiser will pay special attention to the property's compliance with the lawmaking.

Suppose the appraiser spots any improvements that are not up to lawmaking. He must annotation those failures. And he volition make an allowance in his appraisal for the repairs necessary to remove them or brand them compliant.

Water, gas, electricity and other utilities

Each home (or each unit, if you're ownership a multi–family dwelling with two to four units) must accept an electricity supply sufficient to provide lighting and run necessary equipment. If your appraiser notices any exposed, frayed or otherwise dangerous wiring, that volition take to be fixed before your loan tin be canonical.

VA minimum property requirements are concerned that your access to all your utilities tin't exist challenged. So if your electricity, water, gas or sewer lines run over other people's state or apartments, the VA wants to know those people can't all of a sudden cull to interrupt your services. This means you'll demand easements (yous recall: those legal rights to trespass) that guarantee your continuing admission. They must also allow contractors to get to utility lines to maintain and repair them.

All this is pretty standard stuff. And, if they need them, the vast majority of homes already have such easements in place.

One terminal thing: If you are buying one of those multi–unit dwellings, each unit must have its own service shut–offs.

H2o supply and sanitary facilities

No surprises hither. The VA wants to know that the home has a continuous supply of water that's safe to drinkable ("potable"). And that supply must be adequate for showering, bathing and germ-free uses, equally well as drinking.

It too insists on a hot–water supply, sanitary facilities and the safe disposal of sewage. If there's any dubiousness about whether the h2o's drinkable, you lot may have to install a filtration system.

Individual water supply and shared wells

If you use a well, leap, lake, rainwater cistern, belongings tank or some other individual source ("private water supply"), you'll still demand a safe and adequate supply. Samples must be collected and tested by an contained expert. And your h2o must adjust with local dominance regulations or those of the Environmental Protection Bureau. As well, the appraiser will look out for nearby sources of pollution and will want to be sure your supply is a safe distance from them.

You lot'll have to sign a announcement that yous're aware of the condition of your h2o supply. And that includes an acknowledgment of the need to maintain whatsoever filtration arrangement or mechanical chlorinator that exists or is required.

Shared wells are okay providing they meet similar safety–and–acceptable supply conditions. But there must be in place a off-white and enforceable understanding with the other users over rights to supply and maintenance.

Some local government brand connecting to the public water supply mandatory. If that'due south the case where you are (and you lot can), you'll have to.

Individual sewage disposal

The same applies to sewage. If information technology's possible and the local authority says you must, you lot'll take to connect to the public sewers.

If yous tin't exercise that or don't have to, you lot can stick with the existing system. However, that mustn't create a nuisance or pose a threat to public wellness. If yous're putting in a new system for whatsoever reason, it volition have to conform with local health authority codes.

But what if all that exists is a pit privy? Perhaps surprisingly, that'southward fine. It merely has to be in an surface area where such facilities are "customary" (so probably not the Upper Due east Side of Manhattan) and it must comply with local health authority recommendations.

Suppose the habitation you want to buy is in a homeowners' association (HOA) area or a planned development. Sometimes, the HOA or a private company supplies water and/or sewage facilities.

The appraiser must notation such an organisation. And he must obtain documentary proof that h2o quality has been must be approved by relevant wellness authorities. Sewage must exist candy in means that end it from being a threat to public health.

In the issue that local or state authorities don't monitor or enforce compliance, set rates and ensure swift resolution of issues, a trust deed will be needed. That's a legal certificate that should ensure standards are maintained.

Hazards

You desire your side by side habitation to provide a condom and healthy environment for its residents. And y'all don't want it to be at take chances from hazards that undermine its structural soundness or that spoil its occupants' enjoyment of the property.

The VA feels the same way and will require the appraiser to let it know equally quickly equally possible if he identifies annihilation that threatens those.

Lacking conditions

The VA minimum property requirements list some defective conditions that especially carp information technology:

- Construction defects

- Poor workmanship

- Continuing settlement (when soil shifts under the load of foundation structures)

- As well much dampness

- Leaks

- Decay

- Termite infestation

The appraiser will value the abode bailiwick to repairs for these beingness carried out. Only those repairs must fix the problem immediately and forestall recurrence equally far as possible. That appraised sum should reflect the value the dwelling volition have after the repairs take been washed. Only you won't get a VA loan till they've been completed.

Mechanical systems

An appraisement is non a home inspection. If you want a total check of the structure and its systems (furnace, HVAC, appliances ...) you have to pay a specialist home inspector.

So the appraiser won't normally check or test mechanical systems. Yet, she should commonly note whatever obvious defects that suggest one fails to attain the VA's standards of existence safety to operate and protected from subversive elements.

Heating

If the dwelling is in an expanse with a balmy climate, heating may non be needed. In other places, a heating organisation volition be required that can maintain a temperature of at to the lowest degree 50°F in parts of the home that contain plumbing.

That may be a fireplace or infinite heater. But if either of those isn't vented and isn't electric, you'll take to meet some conditions. The owner will need to call in a licensed heating contractor who must certify in writing that an approved oxygen–depletion sensor is in place. That must be up to the local building code or comply with the manufacturer's recommendations.

There'due south no requirement to have air conditioning, regardless of the local climate. But, if it's installed, it must exist operational. If information technology isn't, the appraiser volition value the home as if it's working normally. Just yous won't get your loan approved until it is.

Leased mechanical systems and equipment

Leased systems and equipment belong to someone else. So they can't be included by the appraiser when she'south calculating the value of the abode. This most commonly applies to fuel/propane storage tanks and energy generation systems based on solar panels, wind turbines or similar. If it's leased, it doesn't add value to the home.

Beware of leases that "encumber the title" (lessen your legal rights as the homeowner). Some power purchase agreements exercise that. Those might actually detract from the value of the home because they may make information technology more difficult to sell later.

Alternative free energy equipment

Providing information technology's not leased, alternative energy equipment may add value to the domicile. Solar, air current and geothermal all fall into this category. High–energy efficiency features can, also.

Your appraiser should bear these in mind when calculating the habitation'due south value.

Roof covering

Don't expect an appraiser to scramble over the roof. That'due south a habitation inspector's job.

However, an appraiser might spot defects either internally (through moisture in rooms or the attic suggesting leaks) or externally from the footing. If a roof's leaking and already has iii or more layers of shingles, all the existing shingles will take to be removed and a new layer laid.

Attics

Over again, it's a home inspector'due south task to become up into attics. Your appraiser probably won't. He'll view hands accessible areas simply not others. And he won't move insulation or the current owner's possessions.

If he notices leaks or bereft ventilation, he'll value the dwelling house equally if those don't exist. Merely you'll be told about them and y'all won't get your loan till they're fixed.

Crawl spaces

You've already guessed. It's a home inspector'southward job to enter crawl spaces and your home appraiser probably won't practise and so.

But the appraiser should take a look from the access hatch. She'll need to run into that there's acceptable access to the space, that it'south clear of debris and that information technology's properly ventilated. She'll also desire to be sure the gap between the (highest level of) ground and the floor joists provides enough space for maintenance piece of work. And she'll make sure there's no worrying dampness or pools of standing water.

Those requirements are simply important if it'due south necessary to enter the crawl space in order to maintain or repair plumbing, ducts and any other mechanical systems. If there's no need ever to access the infinite, she'll just exist looking out for adequate ventilation and an absenteeism of excess moisture.

Basements

Again, dampness is the principal issue hither. But the appraiser will also expect out for structural issues.

She'll also look at the sump pump, if one'south installed. Information technology needs to exist safely hard–wired or plugged into a standard electrical outlet via a mill–fitted cord.

Swimming pools

If a pool's been winterized or is clearly non in use, the appraiser won't usually deduct for repairs to the mechanical systems. Absent evidence to the contrary, she'll generally assume they're either working fine or volition exist cheap to fix.

Structural bug are a different story. If she spots large cracks or unstable sides, she can do one of two things.

- She can value the home as if the puddle were sound but get in being properly repaired a condition of your getting your loan.

- Or she can value the habitation as if it didn't have a pool and make the filling in and making good (possibly re–grading the chiliad) of the pool a condition of your getting a loan.

Proper in a higher place–ground pools (complete with a filtration system and decking) in skillful condition should usually be seen by the appraiser equally calculation value to the home. However, that applies just in areas where that blazon of pool is "customary and accepted in the market area." In other words, if all the neighbors' pools are swanky, in–footing ones, your above–ground i may be seen equally non adding value.

If your local authority sets standards for securing pools, yours must meet those. If the pool doesn't, getting up to code will exist added to your repairs list and yous won't become your loan till information technology's washed.

Infiltrator confined

If burglar bars are fitted, each bedroom must have a quick–release mechanism on at least one window. The only exception is if in that location's an outside door from that chamber that allows occupants to escape a burn down easily. This is such an obvious safety consideration that you're unlikely to object.

If quick–release mechanisms are not present or the appraiser can't confirm they work effectively, the removal of infiltrator bars will exist added to your listing of necessary repairs before you get your loan.

Lead–based paint

With standard, non–pb paint, the appraiser typically won't take much discover of internal ornament. That counts as cosmetic. He may, nevertheless, require lacking exterior surfaces to be repainted if impairment may exist being caused by weather.

When information technology comes to lead–based paint, the year 1978 is fundamental hither. If the abode or any addition to it predates that year, then it may exist assumed that the paint present is lead–based. The appraiser will place whatever defective lead–based paint. And it volition have to be remedied, regardless of cost.

It will need to exist either entirely removed or covered and sealed. The former involves washing, scrubbing and wire–brushing to clear abroad whatever defective surfaces. So the application of two coats of not–leaded pigment.

Roofing involves removing the pigment and then roofing with drywall, plywood or plaster. But then can new pigment be practical.

The VA takes this health threat very seriously. Not merely will you not get your loan until the piece of work'south completed, but an appraiser must later inspect the finished job to make sure information technology meets the required standards.

Wood–destroying insects/fungus/dry rot

This is more than of a threat to the construction of the edifice than to human being health. The appraiser will look out for evidence of an insect infestation (especially termites) as well as fungus and dry rot.

For termites, the appraiser will crave an inspection by a specialist exterminator if there'south any bear witness that they're present or have been present. And whatsoever damage must be repaired earlier yous can become your loan.

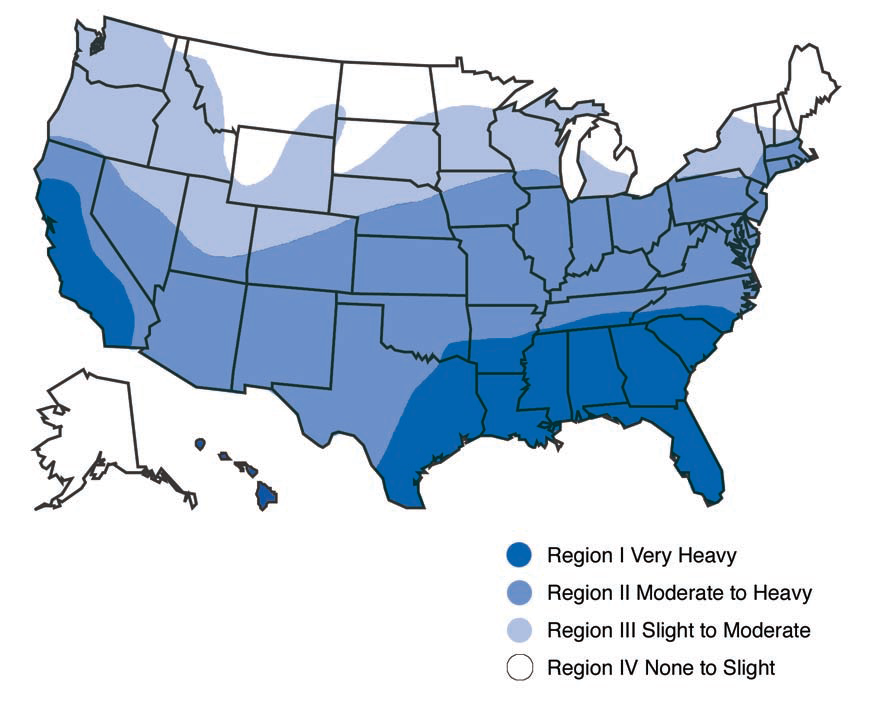

If the domicile is in an area designated "very heavy" or "moderate to heavy" on the following map, such an inspection will exist required even if in that location's no evidence of an infestation. If the holding's on the edge of ane of those areas and you are unsure whether an inspection is required, you can get more localized information on the VA's website.

Source: Relative hazard of subterranean termite infestations in the United states — USDA Woods Service

You probably won't need an inspection if your habitation is a unit of measurement within a high–ascension condominium. And they're usually unnecessary for small, discrete structures such as sheds, unless those count toward the value of the domicile.

Radon gas

Radon gas is an issue just if yous're buying a new home. In that case, the builder must certify that radon–resistant construction techniques were used. And that the home is upwardly to all applicable codes for radon control.

Potential environmental problem

If there's an bodily or potential environmental trouble, the appraiser must take its possible impact on the value of the home into business relationship. You may need state, local or federal regime to certify in writing that there's no issue.

If that's refused because there is one, remedial work will have to be carried out before you lot'll get your loan. The VA lists some examples of ecology bug, merely there may exist others:

- Oil and gas wells, whether operational or abandoned

- Hugger-mugger storage tanks

- Chemic contamination (including methamphetamine, if y'all're ownership from a Walter White wannabe)

- Slush pits

- Soil contagion from sources on or off the belongings

- Hydrogen sulfide gas from petroleum product wells

Stationary storage tanks

The appraiser has to annotation the presence of any large (i,000+–gallon) storage tanks within 300 feet of the holding. That applies to buried (as in a gas station, for instance) and above–ground facilities. Merely only tanks containing flammable or explosive materials need be reported.

If the tanks are likely to bear on the value of the home, the appraiser must brand the necessary deduction based on comparable sales nearby. And you lot, the veteran, will take to sign a document, acknowledging that yous're aware of the presence of the tanks.

Mineral, oil and gas reservations and leases

In that location are two principal threats from such leases. First, they may be an encumbrance, meaning they lessen your rights every bit the homeowner. And secondly, they may detract from the benefits you'd otherwise expect equally a resident. In other words, they may brand the habitation a less nice place to alive.

The appraiser must assess how much either or both those touch on the value of the property and adjust her appraisal accordingly.

High–voltage electric transmission lines and loftier–pressure gas and liquid petroleum pipelines

Loftier–voltage transmission lines and high–pressure gas and L–P pipelines require an easement. Y'all'll remember that'south a "legal correct to trespass" and gives the line'south/pipeline's owners certain rights. No office of the home nor any office of an addition (even a detached 1) can exist located within such an easement.

And, if the property is inside 100 anxiety of one of these easements, the appraiser must mention it in his study.

Backdrop near airports

Your appraiser will know about the different noise– and accident–potential zones around a nearby airport. Yous tin look them up on the FAA's website.

The appraiser must accept into consideration the proximity of the property to the aerodrome and its presence in a zone when assessing the value of the home. She should endeavor to observe comparable sales to guide her.

You won't get a VA loan on a new home that's going to be congenital in a "clear zone" (aka "runway–protection zone"), because those are located almost the terminate of an active runway. If y'all want to buy an existing domicile at that place (even if information technology's newly congenital) or in an accident–potential zone, yous'll accept to sign a document confirming:

I am aware that the belongings being purchased is located almost the end of an aerodrome runway and this may have an effect upon livability, prophylactic, value and marketability of the property.

Manufactured home classified every bit existent estate

The VA will guarantee loans on manufactured (in one case called "mobile") homes but there are strict weather. Most importantly, the abode has to officially be designated as real estate – rather than a "chattel" (personal belonging) or vehicle. You may be able to change its designation, simply it must be zoned correctly.

In addition, information technology must conform with the U.s. Department of Housing and Urban Development'southward HUD Manufactured Home Construction and Prophylactic Standards. It should normally come with a certificate and tags that confirm this.

Other rules mean it must:

- Accept a foundation that can bear the weight of the home and likewise resist potent winds

- Conform with local and state regulations

- Take a floor area of at to the lowest degree 400 square anxiety if it's a unmarried–width unit of measurement or 700 foursquare anxiety if it'southward double–width

If y'all're buying a new unit that'due south yet to exist installed, y'all'll have to provide various plans and specifications.

Read more than almost getting a loan on a manufactured domicile here.

Modular homes

Mainstream modular homes are built in a manufactory, transported to the site and and then assembled on traditional foundations. Once completed, yous can't tell that they weren't traditionally constructed ("stick–built" or "site–built") homes.

In other words, they're every bit every bit skilful as whatever other abode – and sometimes better, because it's easier to build well in a factory environment. For that reason, appraisers should value modular homes in exactly the same way as they would any other.

On–frame modular homes

On–frame modular homes are very different from mainstream modular homes. They're closer to manufactured homes, having been congenital on a chassis. Again, they must be officially designated as real estate.

To get a VA loan on one, it must have:

- Had all its original running gear (wheels and axles) removed

- A crawl space, complete with a vapor barrier and permanent masonry skirting with adequate ventilation

- Access to that clamber space

- A permanent foundation to which it'southward secured and that meets state and local requirements

You remember that sounds a lot like a manufactured home? You're right.

Home inspections and waivers

By now you'll be aware of the limitations of home appraisals. Their principal purpose is to constitute the market value of the abode. And the appraiser needn't be an expert in construction.

If you have concerns about aspects of the structure, whether mentioned in the appraisal report or not, you lot should probably conform a home inspection.

And, if you request a waiver on any repairs listed in your appraisal report, you stand a better chance of making your instance if yous include an inspection study.

Finally, most VA minimum property requirements protect you every flake equally much as they do the department. Try to view them that fashion rather than as bureaucratic nitpicking. Y'all may be glad you did.

Apply for a VA home loan

VA loans are a nothing–down mode to purchase a abode. And despite the lengthy list of requirements above, nearly homes fall well within VA guidelines.

Check your eligibility and today's VA loan rates at the link below.

The information contained on The Mortgage Reports website is for informational purposes merely and is non an advertisement for products offered by Full Beaker. The views and opinions expressed herein are those of the author and do not reflect the policy or position of Total Beaker, its officers, parent, or affiliates.

Source: https://themortgagereports.com/50711/va-minimum-property-requirements-mprs-for-va-home-loans

Posted by: gistablity.blogspot.com

0 Response to "Do All Repairs Need To Br Made For A Va Loan Inspection"

Post a Comment